Oh, Sears. You've come to represent much that is wrong with American corporate culture, especially a CEO who embodies the Dunning-Krueger Effect with every syllable he utters.

Crain's Joe Cahill argues that Eddie Lampert, while Sears' proximate cause of death, didn't act alone in its murder:

There's no denying the hedge fund mogul who thought he knew more about retailing than the retailers made critical errors that turned Sears' struggles into an inexorable decline. But Sears started down the wrong path long before Lampert appeared. And its sad fate isn't so much a story of operational missteps as one of missed opportunity. In short, Sears chose to imitate Walmart when it should have tried to pre-empt Amazon.

Like so many established companies threatened by newcomers with innovative business models, Hoffman Estates-based Sears tried to beat the interlopers at their own game, rather than looking ahead to the next big thing. The company that recognized the potential of railroads to support a nationwide retail operation and foresaw that postwar suburban sprawl and shopping malls would redefine retailing for a new generation failed to appreciate the implications of internet technology for the industry it dominated for more than a century.

As for Lampert, he showed no better vision than his predecessors. When he took control of Sears by merging it with Kmart, the combined company still had an opportunity to carve out a strong presence in e-commerce. Amazon had already emerged as the leading internet retailer, but with $8.49 billion in 2005 revenue, it was one-sixth the size of Sears, and barely profitable.

Meanwhile, two other Crain's stories outline the thousands of other victims of this crime: the company's pensioners and all of the malls about to lose their anchor tenants.

Press reports reckon the company has less than 48 hours to live.

Anyone who has traveled from the US to Canada or Europe notices quickly that their transit systems simply work better. Londoners may moan about the Tube, but one can get from any part of Greater London to any other at almost any time of day using trains or buses.

Writing for Citylab, Jonathan English explains why and how the rest of the world got it right and we got it so very wrong:

[T]o briefly summarize: Transit everywhere suffered serious declines in the postwar years, the cost of cars dropped and new expressways linked cities and fast-growing suburbs. That article pointed to a key problem: The limited transit service available in most American cities means that demand will never materialize—not without some fundamental changes.

Many, though not all, major cities in the U.S. have a number of rail lines radiating out of their centers. Most of them are only used by freight or a few commuter train trips a day. It’s a huge, untapped resource. There’s no reason why those railway lines can’t be turned into what are effectively subway lines—high-capacity routes that allow people to get across the city quickly—without the immense cost of tunneling. In Europe, what we usually call “commuter rail” operates frequently, all day, and cost the same fare as other local transit. That’s the difference between regional rail and commuter rail. A transit system with service that is only useful to 9-to-5 commuters to downtown will never be a useful one for most people.

Fares need to be low enough that people can afford to take transit. New York City will soon join other cities like Tucson and Ann Arbor in having discounted fares for low-income people. That is important to make transit accessible to everyone. But fair fares isn’t just about keeping fares low. It’s also about eliminating arbitrary inequities. People shouldn’t have to pay a transfer penalty or a double fare just because they switch from bus to rail, transfer between agencies, or travel across the city limits. A transfer is an inconvenience—you shouldn’t have to pay extra for it.

Fares should be set for the convenience of riders, not government agencies. A trip of a similar distance should have a similar fare, regardless of whether it’s on a bus or train, or if you have to cross city limits. Commuter rail shouldn’t be a “premium service” that only suburban professionals can afford.This is the kind of unfairness that infuriates people and drives them away from transit.

Chicago, by the way, has contemplated a regional farecard system for decades. Maybe someday...

Crains is reporting this morning that Sears has hired bankruptcy advisors and could file in the next couple of days:

[S]taffers of the advisory firm, New York-based M-III Partners, have been observed at the troubled retailer's Hoffman Estates headquarters in recent days. Sears, meanwhile, continues to evaluate other options that could still avert a trip to Bankruptcy Court.

Separately, Sears added restructuring expert Alan Carr to its board of directors as the company faces critical debt repayments and looks to overhaul its borrowings, the company said earlier today.

Carr is CEO of restructuring advisory firm Drivetrain and has over 20 years of experience with financially distressed companies as both an investor and an adviser, according his firm’s website. Before his current role, he was a distressed-debt and private equity investor at Strategic Value Partners.

Thank you, Eddie. You've done a man's job killing one of Chicago's oldest brands.

The U.N. Intergovernmental Panel on Climate Change released an alarming new report this weekend:

The world stands on the brink of failure when it comes to holding global warming to moderate levels, and nations will need to take “unprecedented” actions to cut their carbon emissions over the next decade, according to a landmark report by the top scientific body studying climate change.

With global emissions showing few signs of slowing and the United States — the world’s second-largest emitter of carbon dioxide — rolling back a suite of Obama-era climate measures, the prospects for meeting the most ambitious goals of the 2015 Paris agreement look increasingly slim. To avoid racing past warming of 1.5 degrees Celsius (2.7 degrees Fahrenheit) over preindustrial levels would require a “rapid and far-reaching” transformation of human civilization at a magnitude that has never happened before, the group found.

Most strikingly, the document says the world’s annual carbon dioxide emissions, which amount to more than 40 billion tons per year, would have to be on an extremely steep downward path by 2030 to either hold the world entirely below 1.5 degrees Celsius, or allow only a brief “overshoot” in temperatures. As of 2018, emissions appeared to be still rising, not yet showing the clear peak that would need to occur before any decline.

Overall reductions in emissions in the next decade would probably need to be more than 1 billion tons per year, larger than the current emissions of all but a few of the very largest emitting countries. By 2050, the report calls for a total or near-total phaseout of the burning of coal.

Meanwhile, the next person to regulate the coal industry in the U.S. will likely come from the coal industry.

As in, "nice work, Dutch military, for unraveling a GRU operation and blowing 300 GRU agents worldwide:"

Dutch authorities have photographs of four Russian military intelligence (GRU) operatives arriving at the Amsterdam airport last April, escorted by a member of the Russian embassy. They have copies of the men’s passports — two of them with serial numbers one digit apart. Because they caught them, red-handed, inside a car parked beside the Organization for the Prohibition of Chemical Weapons in The Hague — the GRU team was trying to hack into the OPCW WiFi system — Dutch authorities also confiscated multiple phones, antennae and laptop computers.

On Thursday, the Dutch defense minister presented this plethora of documents, scans, photographs and screenshots on large slides at a lengthy news conference. Within seconds, the images spread around the world. Within hours, Bellingcat, the independent research group that pioneered the new science of open source investigation, had checked the men’s names against several open Russian databases. Among other things, it emerged that, in 2011, one of them was listed as the owner of a Lada (model number VAZ 21093) registered at 20 Komsomolsky Prospekt, the address of the GRU. While they were at it, Bellingcat also unearthed an additional 305 people — names, birthdates, passport numbers — who had registered cars to that very same address. It may be the largest security breach the GRU has ever experienced.

That's a great way to fight back: exposure. This is an example of the integrity and ingenuity which almost led to the Dutch controlling the world instead of the British way back when.

The Petaluma*, Calif., based company, which has a major production facility here in Chicago, laid off 12% of its workforce:

The workforce reduction will affect every department in the company, which operates a production plant in Chicago and a taproom in Seattle, CEO Maria Stipp said in a prepared statement. Lagunitas employs about 900 people at its Petaluma headquarters, which will take the brunt of the more than 100 layoffs.

The decision to downsize comes 17 months after Dutch brewing giant Heineken International acquired full ownership of the homegrown brewery company, which has long been a supporter of local nonprofits through beer donations and fundraisers at its Petaluma taproom.

The layoffs were not wholly unexpected given cutbacks at other craft brewers with growth slowing in the estimated $26 billion-a-year U.S. craft sector. The sector had incredible growth in recent years, with production rising as much as 20 percent annually as recently as 2014. But in recent years the increases have been in the low single digits.

Who could have predicted that Heineken would want profits more than protecting its workers?

*Petaluma is a million times better than its sister city, Megaluma.

After Eddie Lampert refused to advance any more cash to his failing retail chain, Crain's editorial board concluded Sears may be about to file for bankruptcy protection:

Tracking the slow-motion collapse of what used to be Sears Roebuck has been sort of like watching a glacier melt: You know it's happening, but it's tough to detect it with the naked eye. That is, until a Delaware-size chunk breaks off, which is what happened when the once-giant retailer recently unveiled a "liability management" plan crafted by Sears Holdings' CEO and largest shareholder, hedge fund tycoon Edward Lampert.

Of course, Crain's has lovingly maintained a decades-long tradition of predicting Sears' demise, and there's no telling if or when the company might ever seek bankruptcy protection. But bankruptcies, like avalanches, tend to happen quickly once they're triggered, and it's difficult to see how Sears can maintain its current course—shredding roughly $1.5 billion in cash each year to fund its business operations—without something big giving way, and suddenly.

We shall see. Whatever happens, it's almost a crime. But I've been saying that for years.

Long-time readers know how much I hate what Eddie Lampert has done to Sears (recent example here). Now, apparently, even he thinks the company is done for:

Edward Lampert's proposed debt reduction plan for Sears Holdings is noteworthy for what it doesn't include: any commitment of new funds from the hedge fund mogul/CEO himself for the floundering retailer he has controlled since 2005.

That may be why the plan landed with such a thud on Wall Street. Sears stock tumbled 7 percent after Sears disclosed Lampert's proposal Monday, retraced some ground to close off 2 percent, and then fell another 5 percent early Tuesday. At $1.17 per share late yesterday, Sears was down about 99 percent over the past decade.

Investors have come to expect Lampert to underwrite continuing losses at Sears, which has lost a total of $6.8 billion since 2013. Lampert and affiliates advanced Sears more than $2 billion in the past few years.

Lately, however, Lampert seems to have lost his appetite for Sears IOUs. Now he's more interested in Sears' assets, floating a $400 million offer for the Kenmore appliance brand in August. Even that proposal was nonbinding and contingent on Lampert finding a third party to finance the buyout. In other words, the billionaire isn't willing to risk his own money on Kenmore.

You know the old story: you broke it, you bought it. In this case those things happen cyclically. I think we're finally reaching the end, though.

Writing in Forbes, psychologist Todd Essig says it's perfectly plausible that Brett Kavanaugh has no recollection of what to Christine Blasey Ford was a life-changing event:

It is distinctly possible that his lack of memory is not because it never happened but because he really has no recollection of it taking place. He never encoded the event. Therefore, he cannot remember something he never noticed, even though it proved to be life-altering for someone else.

As Dr. Richard Friedman wrote this week, an attack usually triggers intense emotions and stress hormones that facilitate encoding memories. That is why “you can easily forget where you put your smartphone or what you had for dinner last night or last year. But you will almost never forget who raped you, whether it happened yesterday — or 36 years ago.”

Of course, this doesn’t let [Kavanaugh] off the hook for what he did or at all suggest he either has or doesn’t have the qualities one needs in a Supreme Court Justice. It’s just that he may not be lying about what he recalls. It also doesn’t excuse the self-serving way he transformed the absence of memory into the presence of certainty that something didn’t happen. A judge should know better than to rest his career on such a logical incongruity.

For another take on this phenomenon, check out Deborah Copaken's moving essay in The Atlantic, "My Rapist Apologized."

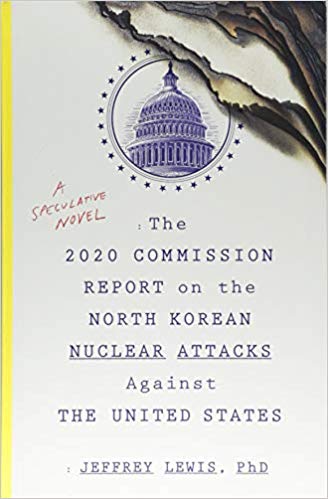

Yesterday I finished Dr. Jeffrey Lewis's speculative novel, The 2020 Commission Report on the North Korean Nuclear Attacks Against the United States. Why scary? Because Lewis lays out, clearly and without hyperbole, a plausible scenario for what could be the most destructive conflict in human history.

In conjunction with Bob Woodward's Fear and the soon-to-be released The Apprentice, it's even scarier—and no less plausible.

Spend $15 and read this book.