The Mega Millions lottery, held in 42 states including Illinois, now has an estimated jackpot over $540m. (The amount will probably be higher as more people buy tickets.) But how much do you really get if you win?

First, you have to choose whether to get 26 annual payments or take the award as a lump sum. The lottery uses a discounted cash flow analysis so that the amount you get as a cash lump is worth the same as 26 equal payments of the whole thing. In other words, if you get a lump sum, you actaully only get the amount that the total award would be worth if you took it in the future.

Take that $540m prize. If you take it as an annuity over 26 years, you get 26 payments of just under $21m each. But a promise of $21m in 2038 is worth a lot less than $21m right now. Think about it: if you have that $21m today, instead of 26 years from now, you can make investments, give it away, buy a lot of stuff that gives you happiness, etc. So how much is $21m in 2038 worth right now? Only $10.7m. Or, put another way, if you take $10.7m in 2038 or $21m today, it's worth about the same—according to the lottery.

We can figure this out by looking at the lump-sum value you would get if you opted for it. If you won today's lottery, Mega Millions will give you $540m only if you take it in 26 payments. Or they'll give you a steaming pile of $389m in cash right now. Because to them, it's the same value.

Why? If you win, you have to make a bet on whether they've estimated something called the discount rate correctly. The discount rate is a guess about how much money will be worth in the future because of things like inflation and the risk that investments change in value. For example, if I bet on a discount rate of 4% (which is historically about middling in the U.S.), I'm betting money gets less valuable by about 4% per year on average. In that case, if I give you the option of taking $100 today or $104 a year from now, and you think the discount rate is 4%, it's an even bet. But if you think the discount rate is 3%, you would take the $104 in a year—because by your estimate, $100 invested today is only going to be worth $103 in a year.

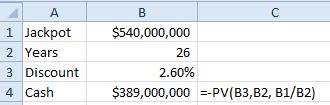

Using a quick Excel function, I figured out that Mega Millions uses a discount rate of 2.6%, well below historical averages but close to what we've seen in the last five years. Here's the calculation:

Yeah, but watch this. If you increase the discount rate to 4%, the estimate of the present value of that $540m drops to $332m, a difference of $57m. In other words, because the lottery uses such a low rate, if you bet that the rate is 1.4% higher, you're betting that you'll come out ahead $57m by taking the money right now instead of over 26 years.

So, great, you're getting $389m in one big pile. Excellent.

Later today I'll talk about your Federal (36%) and Illinois (5%) taxes...and what they might do to the calculation.