I'm juggling a couple of clients today, so I can't write entire entries on any of these:

OK, back to the mines...

Former Chicago mayor Rich Daley got named to Coke's board of directors today. Coca-Cola said:

"Mr. Daley brings significant public policy expertise and experience in creating sustainable growth opportunities for businesses and communities to our Company," said Muhtar Kent, Chairman and Chief Executive Officer of The Coca-Cola Company. "His experience and insights will be invaluable as we continue to work to grow our business and invest in the fabric of the communities we serve."

Daley is also a senior advisor to JPMorgan Chase, where he will chair the new "Global Cities Initiative," a joint project of JPMorgan Chase and the Brookings Institution to help cities identify and leverage their greatest economic development resources. He also serves as a senior fellow at the Harris School of Public Policy at the University of Chicago.

I wonder how long this was in the works? And how long has he advised JPMC, the bank that negotiated our catastrophic parking-meter deal?

Even though we still have two weeks to go, 2011 has already experienced the costliest year of weather disasters in decades:

From extreme drought, heat waves and floods to unprecedented tornado outbreaks, hurricanes, wildfires and winter storms, a record 12 weather and climate disasters in 2011 each caused $1 billion or more in damages — and most regrettably, loss of human lives and property.

The Illinois State Climatologist adds:

We also experienced some $50 billion in total losses for the year. And that is with a fairly quiet hurricane season. Some of those billion dollar disasters had direct impacts on Illinois, including the February blizzard, and the spring flooding.

NOAA has art:

.png)

For photos from the first weather disaster of 2011, check out our archives.

Derp. One year ago yesterday I finished my MBA. It doesn't seem like a full year...except when it doesn't seem like only one year.

I forgot to post this photo from the Tsukiji fish market earlier:

The Kingdom of Saudi Arabia, our friend in the Middle East, has beheaded one of its citizens on the charge of witchcraft:

Amina bint Abdel Halim Nassar was executed Monday for having "committed the practice of witchcraft and sorcery," according to an Interior Ministry statement. Nassar was investigated before her arrest and was "convicted of what she was accused of based on the law," the statement said. Her beheading took place in the Qariyat province of the region of Al-Jawf, the ministry said.

The London-based Saudi newspaper Al-Hayat quoted a source in the country's religious police who said authorities searched Nassar's home and found books on sorcery, a number of talismans and glass bottles filled with liquids supposedly used for the purposes of magic. The source told the paper Nassar was selling spells and bottles of the liquid potions for about $400 dollars each.

"So far at least 79 people -- including five women -- have been executed there, compared to at least 27 in 2010," [Amnesty International] said.

It's tempting to wonder whether they weighed her against a duck first, but really, this isn't funny. What is it really worth to us to support this 7th-century regime?

People in the UK travel much more by train than we in the US. Still, I think office centers at train stations would be great here:

Sitting in a proper office space after missing your train would certainly beat propping a laptop on your knees outside WH Smith as the pigeons wander round your feet. Regus has initiated a similar programme in France, where it is opening drop-in business centres in six stations, and it has plans for more developments in the Netherlands.

It sounds like a reasonable deal for business travellers—depending on the price charged for access.

Sadly, we in the US don't use rail services nearly enough to make this profitable. I can't imagine Metra spending any money on these services here in Chicago, for example, and even if they did, where would they put the office centers?

A client visit up in Manitowoc, Wis., ended a little earlier than planned today, so I was able to:

- Avoid rush-hour traffic in both Milwaukee and Chicago;

- Pick Parker up tonight instead of tomorrow; and

- Snap this photo from the roof of the Lincoln Park Whole Foods:

The loony right (and some on the loony left) have claimed recently that the Federal Reserve has made trillions of dollars of secret loans to banks in the last few years. Fortunately, this has not happened; the Fed has made thousands of overnight billion-dollar loans that everyone knows about.

First, you have to use different rules of math than those of us in the reality-based community to get to the amounts anti-Federal Reserve folks have bandied about recently. Then you have to forget the salient fact that all the loans got paid back:

For example, [Economist James] Felkerson takes the gross new lending under the Term Auction Facility each week from 2007 to 2010 and adds these numbers together to arrive at a cumulative total that comes to $3.8 trillion. To make the number sound big, of course you want to count only the money going out and pay no attention to the rate at which it is coming back in. If instead you were to take the net new lending under the TAF each week over this period—that is, subtract each week's loan repayment from that week's new loan issue—and add those net loan amounts together across all weeks, you would arrive at a cumulative total that equals exactly zero. The number is zero because every loan was repaid, and there are no loans currently outstanding under this program.

But zero isn't quite as fun a number with which to try to rouse the rabble.

In unrelated news, the temperature in Chicago jumped 10°C in the last six hours, so it's time to walk the dog.

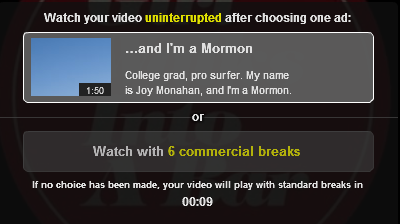

So I thought I'd take another look at Sebastian Gutierrez' film Girl Walks Into a Bar the other day. But before the film started I saw this:

Not knowing what to make of these options, I chose the two minutes of proselytizing and went to make my lunch. When I got back, the movie was on its way without interruptions, as promised.

What the LDS church hopes to accomplish through this PR campaign escapes me for the moment.