In the 49 days and 3 hours or so until poor Crawford, Texas, gets its missing idiot back, let's pause to remember one of the first unmitigated disasters of his administration: Today is the 7th anniversary of Enron filing for bankruptcy.

Also (why is this related? Hmmm), today's Wall Street Journal reports that Ford CEO Alan Mullaly, who yesterday, hat in hand, drove himself to Washington, made more than you did last year:

Ford Chairman William Ford Jr. said the company is looking beyond survival to opportunity. "We want to come blasting out as a global, green, high-tech company that's exactly where the country and the Obama administration want us to head," he said. Ford's recovery plan "isn't just about slashing -- we've already done that slashing and burning -- but about building for the future."

Mr. Mulally added that he would work for $1 a year if Ford received any federal loan or other aid, a change from the view he expressed last month. While testifying before Congress, he was asked if he would be willing to cut his annual salary to that amount and responded, "I think I'm OK where I am." He took home $21.67 million in 2007.

There is hope, and not just on January 20th. Canada will probably get kick out its right-wing government next Monday, thanks to Stephen Harper's tin ear, and Georgia has a chance today to give us a 59-seat majority in the Senate.

Interesting times.

And, as many already suspected, it started a year ago:

The Business Cycle Dating Committee of the National Bureau of Economic Research met by conference call on Friday, November 28. The committee maintains a chronology of the beginning and ending dates (months and quarters) of U.S. recessions. The committee determined that a peak in economic activity occurred in the U.S. economy in December 2007. The peak marks the end of the expansion that began in November 2001 and the beginning of a recession. The expansion lasted 73 months; the previous expansion of the 1990s lasted 120 months.

The Times suggests this wasn't the reason for today's sell-off on Wall Street:

The announcement came as the stock market fell sharply, its first decline in five sessions. The Dow Jones industrial average was off more than 440 points by early afternoon. The Standard & Poor’s 500-stock index fell nearly 6 percent.

Analysts said that after last week’s gains — the biggest five-day rally in decades — a sell-off was to be expected.

"You had the biggest weekly gain in 30, 35 years," said Anthony Conroy, head equity trader at BNY ConvergEx Group. "Some profit-taking is warranted."

...

Monday brought its own share of poor economic news. The manufacturing industry suffered its worst month since 1982, according to a closely watched index published by the private Institution for Supply Management. The index fell to 36.2 in November from 38.9 in October, on a scale where readings below 50 indicate contraction.

That was the worst monthly reading since 1982, and a sign that the worldwide credit crisis was taking a serious toll on American businesses. New orders fell sharply, although export orders held steady from October.

A separate report from the Commerce Department showed that spending on construction projects fell 1.2 percent in October, after staying unchanged in September. Private construction dropped 2 percent with a sharp drop in the residential sector, offering few signs of relief from the housing slump.

More good times.

Via reader KT, the Boston Globe picked up on a map comparison of voting patterns this election and cotton agriculture in the antebellum South:

The bottom map dates from 1860 (i.e. the eve of the Civil War), and indicates where cotton was produced at that time.... The top map dates from 2008, and shows the results of the recent presidential election, on county level. ... The pattern of pro-Obama counties in those southern states corresponds strikingly with the cotton-picking areas of the 1860s, especially along the Louisiana-Mississippi and Mississippi-Alabama borders (the pattern corresponds less strikingly and deviates significantly elsewhere).

The link between these two maps is not causal, but correlational, and the correlation is African-Americans.

In related news, the runoff for the Georgia U.S. Senate seat currently held by Saxby Chambliss (R) will go ahead. We'll see.

Writer Neal Gabler says it's not about Goldwater, it's about McCarthy:

McCarthy, Wisconsin's junior senator, was the man who first energized conservatism and made it a force to reckon with. When he burst on the national scene in 1950 waving his list of alleged communists who had supposedly infiltrated Harry Truman's State Department, conservatism was as bland, temperate and feckless as its primary congressional proponent, Ohio Sen. Robert Taft....

McCarthy was another thing entirely. What he lacked in ideology—and he was no ideologue at all—he made up for in aggression. Establishment Republicans, even conservatives, were disdainful of his tactics, but when those same conservatives saw the support he elicited from the grass-roots and the press attention he got, many of them were impressed. Taft, no slouch himself when it came to Red-baiting, decided to encourage McCarthy, secretly, sealing a Faustian bargain that would change conservatism and the Republican Party. Henceforth, conservatism would be as much about electoral slash-and-burn as it would be about a policy agenda.

Speaking of the GOP's legacy, we could be looking at spending $8.5 trillion ($8,500,000,000,000) to clean up the post-Shrub mess:

Just last week, new initiatives added $600 billion to lower mortgage rates, $200 billion to stimulate consumer loans and nearly $300 billion to steady Citigroup, the banking conglomerate. That pushed the potential long-term cost of the government's varied economic rescue initiatives, including direct loans and loan guarantees, to an estimated total of $8.5 trillion -- half of the entire economic output of the U.S. this year.

Nor has the cash register stopped ringing. President-elect Barack Obama and congressional Democrats are expected to enact a stimulus package of $500 billion to $700 billion soon after he takes office in January.

The spending already has had a dramatic effect on the federal budget deficit, which soared to a record $455 billion last year and began the 2009 fiscal year with an amazing $237-billion deficit for October alone. Analysts say next year's budget deficit could easily bust the $1-trillion barrier.

Happy times, happy times.

Via Talking Points Memo, President-Elect Obama will announce Hillary Clinton as his nominee for Secretary of State tomorrow in Chicago:

Obama plans to announce the New York senator as part of his national security team at a press conference in Chicago, [Democratic officials] said Saturday. They requested anonymity because they were not authorized to speak publicly for the transition team.

In unrelated news, today is the last day of the Atlantic hurricane season.

Why? Why? Why?

The only thing that makes sense to me: someone wants to start a war. I hope to all humanity India and Pakistan keep their senses over the next few days. So do the Indians and Pakistanis, I expect.

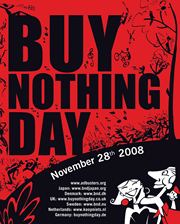

Today (in North America; tomorrow worldwide) is the 17th Annual Buy Nothing Day, "sponsored" by Adbusters:

Today (in North America; tomorrow worldwide) is the 17th Annual Buy Nothing Day, "sponsored" by Adbusters:

Suddenly, we ran out of money and, to avoid collapse, we quickly pumped liquidity back into the system. But behind our financial crisis a much more ominous crisis looms: we are running out of nature… fish, forests, fresh water, minerals, soil. What are we going to do when supplies of these vital resources run low?

There’s only one way to avoid the collapse of this human experiment of ours on Planet Earth: we have to consume less.

It will take a massive mindshift. You can start the ball rolling by buying nothing on November 28th. Then celebrate Christmas differently this year, and make a New Year’s resolution to change your lifestyle in 2009.

It’s now or never!

Calculated Risk hits the nail on the head: "[W]hat happens to U.S. interest rates if China slows their investment in dollar denominated assets?"

Hint: nothing good...

Essay by Liar's Poker author Michael Lewis, in December's Conde Nast Portfolio:

In the two decades since [1989], I had been waiting for the end of Wall Street. The outrageous bonuses, the slender returns to shareholders, the never-ending scandals, the bursting of the internet bubble, the crisis following the collapse of Long-Term Capital Management: Over and over again, the big Wall Street investment banks would be, in some narrow way, discredited. Yet they just kept on growing, along with the sums of money that they doled out to 26-year-olds to perform tasks of no obvious social utility. The rebellion by American youth against the money culture never happened. Why bother to overturn your parents' world when you can buy it, slice it up into tranches, and sell off the pieces?

Via Calculated Risk, Merriam-Webster has declared "bailout" its word of the year:

The word "bailout," which shot to prominence amid the financial meltdown, was looked up so often at Merriam-Webster’s online dictionary that the publisher says it was an easy choice for its 2008 Word of the Year.

The rest of the list is not exactly cheerful. It also includes "trepidation," "precipice" and "turmoil."

"There's something about the national psyche right now that is looking up words that seem to suggest fear and anxiety," said John Morse, president of Springfield-based Merriam-Webster.

Go figure.