Remember how I love my car? I love it even more today, and I'm a bit spooked by its costs.

A new filling station opened up about 1500 m from my house, and they have the lowest gas prices around. Even though I last filled my car on November 24th, in Indiana, and even though I've driven 1,623 km since then, I still had half a tank of gas. So for $10, I put 21 L of regular into the tank, which means my car cost me 0.6¢ per kilometer to operate over the last 144 days, and I got an average of 1.3 L/100 km fuel economy.

I have not paid that little for fuel—47.5¢/L—since January 2004. (In fairness, the car I owned then used premium gas.)

That said, I have not seen that fuel price in real terms since 2002. In fact, back when I bought my first car in June 1989, regular gas cost 32.5¢/L, which would be 67.6¢/L adjusted for inflation.

We live in very strange times.

No, really, the president Tweeted that earlier today:

I mean, what the actual f? (He also wants to liberate Michigan and Virginia, by the way.) Charlie Pierce warned only Monday that this kind of nonsense was coming:

The acting director of the Office of National Intelligence is encouraging citizens to break local laws, endangering themselves and others, in the middle of a pandemic. Of all the screwy moments that we have experienced since the founding of Camp Runamuck, this is going to rank very close to the top. And it is not going to be a surprise to anyone if another AstroTurf movement similar to the Tea Party rises, especially if the president* “opens up” the country at the beginning of May.

This nonsense is coming, and it’s going to be encouraged by the national government, and I don’t know how we avoid it.

Andrew Sullivan, after point out that the virus doesn't have a social message, breathed a sigh of relief that Trump is so very lazy:

But of course we all know by now, including the Republicans, that it is meaningless. Trump claims the powers of a tyrant, behaves like one, talks like one, struts like one, has broken every norm a liberal democracy requires, and set dangerous precedents that could enable a serious collapse in constitutional norms in the future.

This, in Bill Kristol’s rather brilliant phrase, is “performative authoritarianism.” It has a real cost — it delegitimizes liberal democracy by mocking it and corrodes democratic institutions by undermining them. But it is not the cost of finding ourselves run by an American Victor Orban. Orban saw the coronavirus emergency the way most wannabe strongmen would and the way I feared Trump might: as an opportunity to further neuter any constitutional checks on him and rule by decree. Trump saw it purely as an obstacle to his reelection message about a booming economy, a blot on his self-image, an unfair spoiling of his term. Instead of exploiting it, he whined about it. He is incapable of empathy and so simply cannot channel the nation’s grief into a plan of action. So he rambles and digresses and divides and inflames. He has managed in this crisis to tell us both that he is all-powerful and that he takes no responsibility for anything.

And I suspect that this creepy vaudeville act, in a worried and tense country, is beginning to wear real thin. A man who claims total power but only exercises it to protect his personal interests, a man who vaunts his own authority but tolerates no accountability for it, is impressing no one.

The emergency I feared Trump could leverage to untrammeled power may, in fact, be the single clearest demonstration of his incompetence and irrelevance

Simply put, "Trump can't lie his way out of this one," as several pundits have observed. Also:

Fun times, fun times. Good thing it will actually seem like spring tomorrow in Chicago after another snowfall last night.

The number of new Covid-19 cases per day may have peaked in Illinois, but that still means we have new cases every day. We have over 10,000 infected in the state, with the doubling period now at 12 days (from 2 days back mid-March). This coincides with unpleasant news from around the world:

- Covid-19 has become the second-leading cause of death in the United States, accounting for 12,400 deaths per week, just behind heart disease which kills about 12,600.

- More than 5 million people filed for unemployment benefits last week, bringing the total unemployed to 22 million, the highest percentage of Americans out of work since 1933. April unemployment figures come out May 8th, when we will likely have confirmation of a 13-15% unemployment rate. Note that the unemployment rate was the lowest in history just two months ago.

- Consumer spending on nearly everything except groceries has fallen, in some places catastrophically. Chicago's heavy-rail authority, Metra, has seen ridership fall 97% system-wide and predicts a $500 million budget deficit this year. (For my own part, since my March 31st post on the subject, my spending on dining out, lunch, and groceries combined has fallen 70% month-over-month.)

- UK Foreign Secretary (and acting Prime Minister) Dominic Raab announced today that lockdown measures would continue in the UK "for at least the next three weeks," reasoning that premature relaxation would lead to a resurgence of the virus as seen worldwide in 1918.

- FiveThirtyEight explains why Covid-19 has caused so much more disruption than Ebola, SARS-1, and swine flu.

- Talking Points Memo takes a deeper look at the hidden mortality of Covid-19.

- Brian Dennehy has died at 81.

- Chicago could get 75 mm of snow tonight. In April. The middle of Spring. FFS.

But we also got some neutral-to-good news today:

I pitched the Goat-2-Meeting to my chorus board for our next meeting, and unfortunately got told we don't donate to other NPCs. I guess we're not a bleating-heart organization.

Illinois' doubling time for Covid-19 cases has increased from 2.1 days to 7.9 days, as of yesterday.

In other news:

And finally, I'll leave you with this touching performance of Tears for Fears' "Mad World" by its composer, Curt Smith, and his daughter Diva:

Writing for Vox, Ezra Klein looks at three major plans for re-starting the economy, and how difficult they would actually be to implement:

There’s one from the right-leaning American Enterprise Institute, the left-leaning Center for American Progress, Harvard University’s Safra Center for Ethics, and Nobel Prize-winning economist Paul Romer.

In different ways, all these plans say the same thing: Even if you can imagine the herculean political, social, and economic changes necessary to manage our way through this crisis effectively, there is no normal for the foreseeable future. Until there’s a vaccine, the US either needs economically ruinous levels of social distancing, a digital surveillance state of shocking size and scope, or a mass testing apparatus of even more shocking size and intrusiveness.

All of them then imagine a phase two, which relaxes — but does not end — social distancing while implementing testing and surveillance on a mass scale. This is where you must begin imagining the almost unimaginable.

The CAP and Harvard plans both foresee a digital pandemic surveillance state in which virtually every American downloads an app to their phone that geotracks their movements, so if they come into contact with anyone who later is found to have Covid-19, they can be alerted and a period of social quarantine can begin.

The AEI proposal is the closest thing to a middle path between these plans. It’s more testing, but nothing approaching Romer’s hopes. It’s more contact tracing, but it doesn’t envision an IT-driven panopticon. But precisely for that reason, what it’s really describing is a yo-yo between extreme lockdown and lighter forms of social distancing, continuing until a vaccine is reached.

This, too, requires some imagination. Will governors who’ve finally, at great effort, reopened parts of their economies really keep throwing them back into lockdown every time ICUs begin to fill? Will Trump have the stomach to push the country back into quarantine after he’s lifted social distancing guidelines? What if unemployment is 17 percent, and his approval rating is at 38 percent?

For the time being, we'll stay in our homes and away from other people as much as we can. But wow, even for me, an introvert with a dedicated home office, it's very trying.

And how long will it go on? A while. National Geographic says a vaccine may take a lot longer than a year.

An Andy Borowitz bit from last year is making the rounds again: "Trump Comes Out Strongly Against Intelligence." More evidence of why that's true after these two videos. First, the Ohio Department of Health demonstrates social distancing:

Second, the Lincoln Project, a Republican organization headed by George Conway, has put out this ad:

And now the roundup of horror promised above:

Finally, 50 years ago today, Paul McCartney announced the Beatles had broken up.

Oh wait: here's another cool video.

Unemployment claims jumped another 6.6 million in the US last week bringing the total reported unemployed to 16.8 million, the largest number of unemployment claims since the 1930s. Illinois saw 200,000 new claims, an all-time record, affecting 1 in 12 Illinois workers. And that's just one headline today:

After all of that, why don't you watch this adorable video of skunks chattering away as they investigate a cyclist?

As we go into the fourth week of mandatory working from home, Chicago may have its warmest weather since October 1st, and I'm on course to finish a two-week sprint at work with a really boring deployment. So what's new and maddening in the world?

And finally, two big gyros manufacturers, Kronos and Grecian Delight, are merging. Kind of like all the lamb and stuff that merges to form gyros.

Enjoy the weather, Chicago. The cold returns Thursday.

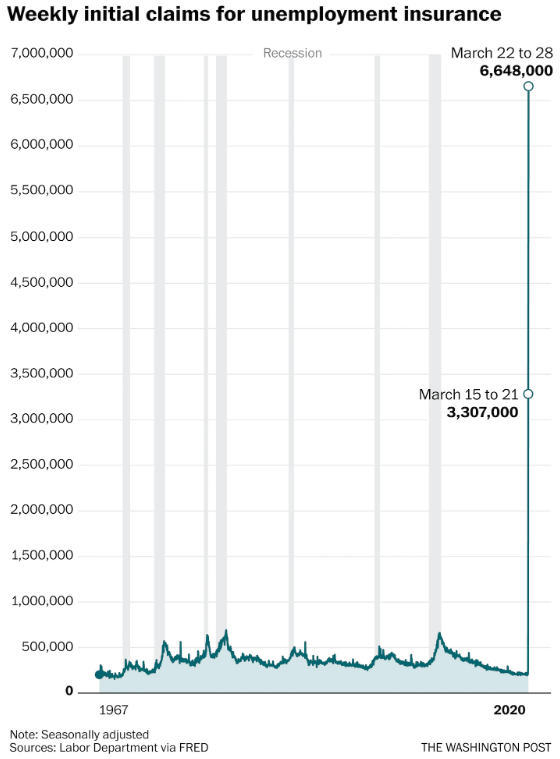

More than 6.6 million Americans filed for unemployment insurance last week (including 178,000 in Illinois), following the 3.3 million who filed the week before. This graphic from The Washington Post puts these numbers in perspective:

Hotel occupancy has crashed as well, down 67% year-over-year, with industry analysts predicting the worst year on record.

In other pandemic news:

Finally, unrelated to the coronavirus but definitely related to our natural environment, the Lake Michigan/Huron system recorded its third straight month of record levels in March. The lake is a full meter above the long-term average and 30 cm above last year's alarming levels.

Illinois Governor JB Pritzker extended the state's stay-at-home order through April 30th, which came as absolutely no surprise, as the state nears 6,000 total COVID-19 cases. Rush Hospitals predict 19,000 total cases in Illinois a week from now—far less than the 147,000 they predict would have shown up without the stay-at-home order.

In other news:

- During the Obama administration, the Health and Human Services Department paid $14 million to a Pennsylvania firm to manufacture low-cost ventilators that we could stockpile for emergencies. They took the money and never manufactured the inexpensive devices, preferring to make expensive ones instead.

- Kellyanne Conway previewed the lies the Trump Campaign will spread this fall, in particular that "no one could have predicted" the pandemic that literally everyone paying attention predicted.

- Speaking of moronic right-wing authoritarians, the dictator of Belarus believes that virus-control efforts are psychotic, and refuses to do anything to halt its spread there.

- Two economists at UC-Berkeley argue that the American relief effort, which focused on paying people directly, could have prevented lasting damage to the economy by paying employers to keep them employed instead, as most other democracies have done.

- Consumer Reports recommends using actual disinfectants to disinfect, not homemade sanitizer, vodka, vinegar, or tea tree oil.

- Stores have made changes to keep people separated and reduce the spread of the coronavirus.

- Looking to the near future, Libby Watson argues in The New Republic that COVID-19 will make our ongoing health insurance crisis unimaginably worse.

- Siddhartha Mukherjee, writing in the New Yorker, examines how the virus behaves within a human body.

- Finally, our very own moronic right-wing would-be authoritarian has used the distraction of the virus to roll back all of Obama's climate policy, today by loosening environmental standards for cars.

Oh, and the stock market suffered its worst first quarter. Ever.